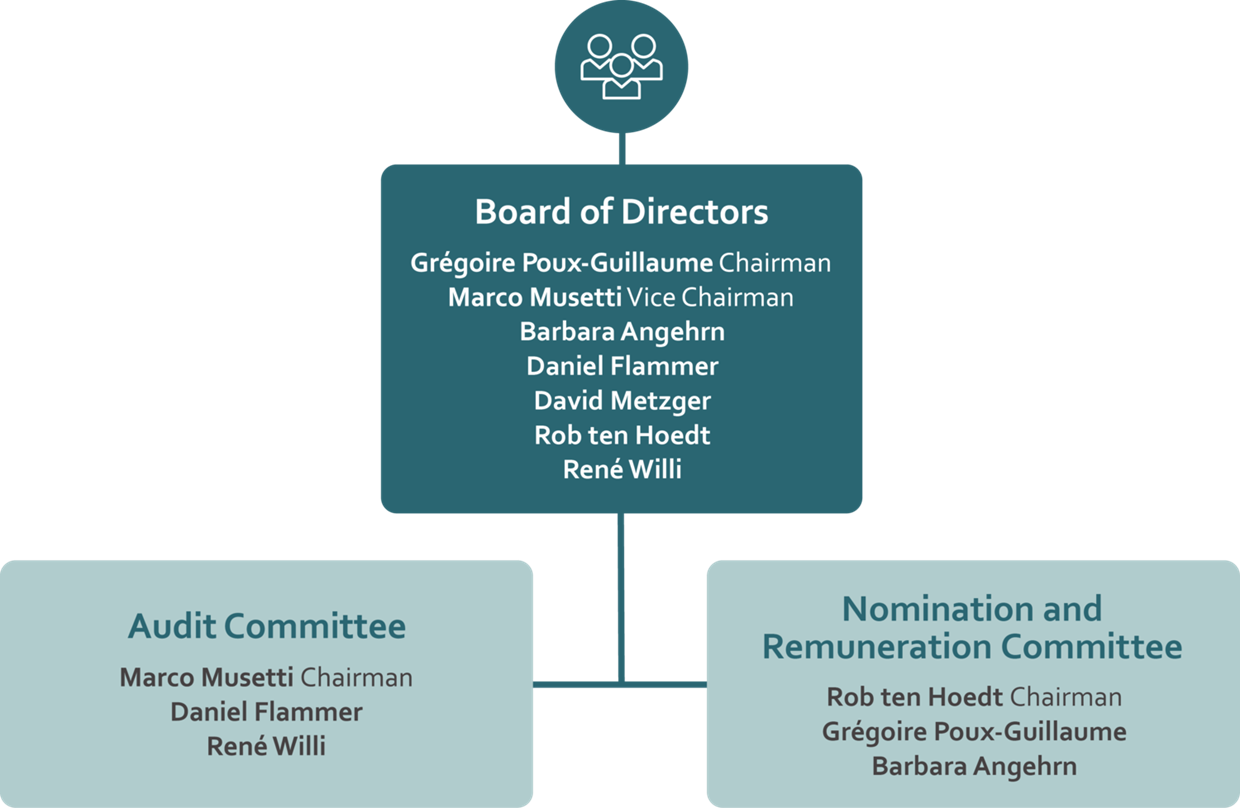

— Corporate governance — Board of Directors

Board of Directors*

None of the board members has been, or currently is, a member of the Executive Committee of medmix Ltd or any of its subsidiaries. In addition, no significant business relationships exist between members of the Board of Directors and medmix Ltd or subsidiaries of medmix Ltd.

medmix group is the former Applicator Systems division of Sulzer group, which was spun off on September 20, 2021, and became medmix Ltd. Hence, medmix Ltd was only incorporated on September 20, 2021. During a transitional period, Sulzer Management Ltd (either directly or through its affiliates) therefore continues to provide certain corporate support services, such as accounting, treasury, tax, internal audit, legal, risk management, compliance and investor relations services. For detailed information on transactions with related parties, please see note 29 to the consolidated financial statements.

* With amended chart in section Operating principles of the Board of Directors and its Committees

Elections and terms of office

Art. 18 of the Articles of Association (on medmix.swiss/en/Investors/Governance; under Downloads) stipulates that the Board of Directors of medmix Ltd shall comprise three to seven members. Each member is elected individually. The term for members of the Board of Directors is one year until the next AGM, but re-election is possible. At the AGM of April 12, 2022, two Board members were re-elected, all for terms of one year. Jill Lee did not stand for re-election. René Willi, Rob ten Hoedt, Barbara Angehrn, David Metzger and Daniel Flammer were elected as additional members of the Board of Directors. The Board of Directors consists of seven members: two from Switzerland, one from Switzerland/Serbia, one from the Netherlands, one from Switzerland/France, one from Switzerland/Italy and one from France. Professional expertise and international experience played a key role in the selection of the members of the Board of Directors.

According to Art. 4 of the Organizational Regulations of the Board of Directors (on medmix.swiss/en/Investors/Governance; under Downloads), the term of office of a board member ends no later than on the date of the AGM in the year when the member reaches the age of 70. The Board of Directors can make exceptions up to but not exceeding the year in which the member reaches the age of 73.

Internal organization

The Board of Directors constitutes itself, except for the Chairman of the Board of Directors who is elected by the Shareholders’ Meeting. The Board of Directors appoints from among its members the Vice Chairman of the Board of Directors and the members of the Board Committees, except for the members of the Nomination and Remuneration Committee, who are elected by the Shareholders’ Meeting. In addition, the Board of Directors appoints a secretary, who does not need to be a member of the Board.

There are currently two standing Board Committees (for their constitutions, see below):

- the Audit Committee

- the Nomination and Remuneration Committee

The Organizational Regulations of the Board of Directors and the relevant Committee Regulations, which are published on medmix.swiss/en/Investors/Governance (under Downloads), define the division of responsibilities between the Board of Directors and the CEO. They also define the authorities and responsibilities of the Chairman of the Board of Directors and of the two standing Board Committees.

Members of the Board of Directors

Grégoire (Greg) Poux-Guillaume, Chairman of the Board of Directors, member of the Nomination and Remuneration Committee and member of the Audit Committee[1], is a French citizen born in 1970.

[1] Until April 12, 2022.

Binding interests: None.

Greg Poux-Guillaume has been the Chief Executive Officer and Chairman of the Board of Management of Akzo Nobel since November 2022. Before joining Akzo Nobel he was Chief Executive Officer of Sulzer Ltd until February 18, 2022, a position he held from 2015. He joined Sulzer from General Electric, where he had been named CEO of GE Grid Solutions upon GE’s takeover of Alstom’s energy businesses. Previously, he was a member of the Board of Directors of Delachaux SA (2012 to 2018). From 2011 to 2015, he was Executive Vice President of Alstom Group (member of the Executive Committee) and served as President and CEO of Alstom Grid. From 2009 to 2011, he was a Senior Managing Director at CVC Capital Partners. Prior to this, he held various positions with Alstom Group (2003 to 2008), in technology venture capital with Softbank and in consulting with McKinsey & Company. Greg Poux-Guillaume started his career in Exploration and Production with Total (1993 to 1997). He has been a member of the Board of Directors of the Swiss-American Chamber of Commerce since 2019. He holds an MBA from Harvard Business School, USA and a Master of Science, Mechanical Engineering from the Ecole Centrale Paris, France.

Jill Lee[2], member of the Board of Directors, member of the Nomination and Remuneration Committee and Chairwoman of the Audit Committee is a citizen of Singapore born in 1963.

[2] Until April 12, 2022.

Binding interests: Member of the Board of Directors and Chairperson of the Audit Committee of Schneider Electric SE, Switzerland; member of the Advisory Board of the Nanyang Technological University, Singapore; member of the Foundation Board of the IMD Business School, Switzerland.

Jill Lee was the Chief Financial Officer of Sulzer Ltd from 2018 and retired in May 2022. From 2011 until 2018, she was a member of the Board of Directors of Sulzer Ltd. She has been a member of the Board of Directors and of the Audit Committee of Schneider Electric since 2020 and the Chairperson of the Audit Committee since 2022. Previously, she was a member of the Supervisory Board of Signify Ltd, where she acted as Chairperson of the Audit Committee (2017 to 2020). From 2015 to 2018, she was the Senior Group Vice President and Head of Next Level Program Management of ABB Ltd. From 2012 to 2014, she was the Senior Vice President and CFO for ABB China and North Asia Region. Prior to this, she served as Senior Vice President, Finance Strategy and Investments for Neptune Orient Lines in Singapore (2010 to 2011). She has also held a number of leadership positions with Siemens, including Global Chief Diversity Officer (2008 to 2010), North-East Region CFO and Senior Executive Vice President of Siemens in China (2004 to 2008), CFO and Senior Vice President of Siemens in Singapore (2000 to 2004). She is currently a member of the Advisory Board of the Nanyang Technological University in Singapore and a member of the Foundation Board of the IMD Business School in Switzerland. She holds an MBA in Business Administration from Nanyang Technological University and a Bachelor's Degree in Business Administration from the National University of Singapore.

Marco Musetti, Vice Chairman of the Board of Directors, Chairman of the Nomination and Remuneration Committee[3], and Chairman of the Audit Committee[4], is a Swiss and Italian citizen born in 1969.

[3] Until April 12, 2022.

[4] Since April 12, 2022.

Binding interests: Member of the Board of Directors of United Company RUSAL; member of the Board of Directors of Octo Telematics; President of the Board of Directors of GEM Capital Ltd; member of the Board of Directors of UMK; member of the Board of Directors of Kalahari Minerals Marketing Ltd.

Marco Musetti has been a member of the Board of Directors of United Company Rusal Plc (today United Company RUSAL, international public joint-stock company) since 2016, a member of the Board of Directors of Octo Telematics since 2017, the President of the Board of Directors of GEM Capital Ltd since 2018, a member of the Board of Directors of UMK since 2014, and a member of the Board of Directors of Kalahari Minerals Marketing Ltd since 2021. Marco Musetti was also a member of the Board of Directors of Sulzer Ltd from 2011 to April 2021, a member of the Board of Directors of Schmolz+Bickenbach AG (today Swiss Steel Holding AG) from 2013 to 2019 and a member of the Board of Directors of Kalahari Trading Ltd from 2017 to November 2021. Previously, he was COO and deputy CEO of Aluminium Silicon Marketing (Sual Group) (2000 to 2007), Head of Metals and Structured Finance Desk for Banque Cantonale Vaudoise (1998 to 2000), and Deputy Head of Metals Desk for Banque Bruxelles Lambert (1992 to 1998). Marco Musetti holds a Master of Science in Accounting and Finance from the London School of Economics and Political Science, UK, and a Master's degree in Economics from the University of Lausanne, Switzerland.

Barbara Angehrn[5], member of the Board of Directors, and member of the Nomination and Remuneration Committee, is a Swiss and Serbian citizen born in 1974.

Binding interests: None

Barbara Angehrn was a Member of the Executive Committee of Vifor Pharma (acquired in August 2021 by CSL), initially as Chief Business & Marketing Officer, responsible for all Global Commercial Functions as well as the overall Nephrology portfolio, then as Chief Business & Operating Officer with responsibility for the Technical Operations, Manufacturing, IT and other Corporate functions. Prior to Vifor Pharma, Barbara was an entrepreneur and held various senior positions as Vice President Europe at Exelixis, Head of Commercial Operations EMEA at Onyx Pharmaceuticals after having spent more than 9 years at Amgen in various leadership roles. Barbara holds a Bachelor's & Master’s degree from the University of St. Gallen, Switzerland.

[5] Barbara Angehrn was elected at the AGM 2022.

Rob ten Hoedt[6], member of the Board of Directors, and Chairman of the Nomination and Remuneration Committee, is a Dutch citizen born in 1960.

Binding interests: Chairman of the Board of Directors of MedTech Europe, the Association representing the medical technology industry in Europe; member of the Board of Directors of Fagron International, member of the Board of Directors of NLC Health, a European Healthtech Venture Builder.

Rob ten Hoedt is to date the Executive Vice President & President, Global Regions of Medtronic, and he is a member of the Company’s Executive Committee. From 2014, his role was Executive Vice President & President Europe, Middle East & Africa (EMEA) to which Asia-Pacific (APAC) was added from May 2022. He has previously held different business and regional leadership positions in Medtronic since joining Medtronic in 1991. Prior to Medtronic, Rob worked in several medical technology companies including Arjo Hospital Equipment and Polystan Benelux and he also ran his own medical equipment distribution company. Rob graduated from the HAN University of Applied Sciences.

[6] Rob ten Hoedt was elected at the AGM 2022.

René Willi[7], member of the Board of Directors, and member of the Audit Committee, is a Swiss citizen born in 1967.

Binding interests: Board positions in companies controlled by Henry Schein

Since 2021, René Will has been Chief Executive Officer of the Global Oral Reconstruction Group at Henry Schein Inc. and a member of the Henry Schein Inc. Executive Management Committee. Before joining Henry Schein in 2013, René Willi was Executive Vice President, Surgical Business Unit, at Institut Straumann AG in Basel, Switzerland, a company he joined in 2005. Prior to Straumann, René held roles in the cardiovascular division of Medtronic. Before that, René served as a management consultant with McKinsey & Company. René started his career in plant engineering as a process engineer (Ems-Inventa) and senior manager sales & engineering (Von Roll Inova AG). René graduated from the ETH Zürich with a PhD in Chemistry and a Master in Industrial Management.

[7] René Willi was elected at the AGM 2022.

David Metzger[8], member of the Board of Directors, is a Swiss and French citizen born in 1969.

Binding interests: Member of the Board of Directors of Sulzer, Switzerland; member of the Board of Directors of Octo Telematics, Italy.

David Metzger is Managing Director Investments and Portfolio Manager for Liwet Holding AG. Previously, David held senior positions in Witel AG, and with its predecessor company RMAG as Deputy Managing Director M&A. Prior to this, he held various roles at Good Energies Inc. (part of Cofra Group), Bain & Company, Novartis, and Morgan Stanley. David graduated from the University of Zürich with a Master's degree in Finance as well as from the INSEAD with an MBA.

[8] David Metzger was elected at the AGM 2022.

Daniel Flammer[9], member of the Board of Directors, and member of the Audit Committee, is a Swiss citizen born in 1969.

Binding interest: Supervisory Board or Board of Directors positions at AdvisReal AG (since 2018) and AR Professional Services AG (since 2021). Chairman of the Board of Directors of altrimo treuhand group AG Appenzell (since 2019) and Tiwel Holding AG Zurich (since 2019).

Daniel Flammer has been Managing Partner of AR Financial Advisory AG in Zurich since April 2018 where he provides transaction advisory and CFO advisory services. Previously, he was a Partner in Audit & Advisory at Deloitte AG Zurich (1998/2004 to 2018), after starting his career with Hess Revisions- und Wirtschaftsberatungs AG & Hess Grant Thornton AG (1996 to 1998), ALFA Treuhand- und Revisions AG (1988–1996) and Communal Administration of Niederburen in St. Gallen (1985–1988). Daniel qualified as a certified public accountant in 1997 and previously graduated from the University of Applied Sciences for Business HWV St. Gallen (Betriebsökonom HWV/FHSG). He was certified as an International Director at INSEAD in 2018.

[9] Daniel Flammer was elected at the AGM 2022.

Operating principles of the Board of Directors and its Committees

All decisions are made by the full Board of Directors. For each application, written documentation is distributed to the members of the Board of Directors ahead of each meeting. The Board of Directors and the Committees meet as often as required by the circumstances. The Board of Directors meets at least five times per year, the Audit Committee and the Nomination and Remuneration Committee meet at least four times per year. The Board of Directors shall be deemed quorate if at least half of its members are present. Resolutions of the Board of Directors are passed upon the majority of votes cast. In case of a tie, the Chairperson of the meeting shall have the casting vote.

In 2022 the Board held five ordinary meetings, lasting on average 5 hours 20 minutes and seven extraordinary meetings (either in person or via video conference), lasting on average 40 minutes. The Nomination and Remuneration Committee held five meetings in 2022, lasting an average of 1.5 hours, while the Audit Committee held four meetings, lasting an average of 1.5 hours. For further details, see the table below. The CEO, the CFO and the Secretary of the Board of Directors also generally attend the Board meetings in an advisory role. Other members of the Executive Committee, the Leadership Team as well as other selected executives are invited to attend Board meetings as required to provide their specific input on midterm planning, the strategy, the budget, market segment-specific items or investments and acquisitions.

The Committees do not make any decisions, but rather review and discuss the matters assigned to them and submit the required proposals to the full Board of Directors for a decision. At the next full Board meeting following the Committee meeting, the Chairpersons of the Committees report to the full Board of Directors on all matters discussed, including key findings, opinions and recommendations.

|

Members of the Board |

|

|

|

|

|

|

|

|

|

Attending meetings of the |

||||

|

Name |

|

Nationality |

|

Position |

|

Entry |

|

Elected until |

|

Board |

|

AC |

|

NRC |

|

Grégoire Poux-Guillaume |

|

French |

|

Chairman |

|

September 2021 |

|

2023 |

|

12 |

|

|

|

|

|

|

|

|

|

Member AC 10) |

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

Member NRC |

|

|

|

|

|

|

|

|

|

5 |

|

Marco Musetti |

|

Swiss/Italian |

|

Vice Chairman of the Board |

|

September 2021 |

|

2023 |

|

12 |

|

|

|

|

|

|

|

|

|

Chairman AC 11) |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

Chairman NRC 12) |

|

|

|

|

|

|

|

|

|

2 |

|

Jill Lee 13) |

|

Singaporean |

|

Chairwoman AC |

|

September 2021 |

|

2022 |

|

4 |

|

|

|

|

|

|

|

|

|

Member NRC |

|

|

|

|

|

|

|

|

|

2 |

|

Barbara Angehrn |

|

Swiss/Serbian |

|

Member NRC 14) |

|

April 2022 |

|

2023 |

|

7 |

|

|

|

3 |

|

Rob ten Hoedt |

|

Dutch |

|

Chairman NRC 15) |

|

April 2022 |

|

2023 |

|

6 |

|

|

|

3 |

|

René Willi |

|

Swiss |

|

Member AC 16) |

|

April 2022 |

|

2023 |

|

7 |

|

3 19) |

|

|

|

David Metzger |

|

Swiss/French |

|

Member of the Board 17) |

|

April 2022 |

|

2023 |

|

7 |

|

|

|

|

|

Daniel Flammer |

|

Swiss |

|

Member AC 18) |

|

April 2022 |

|

2023 |

|

6 |

|

3 19) |

|

|

|

AC = Audit Committee, NRC = Nomination and Remuneration Committee |

||||||||||||||

10) Until April 12, 2022.

11) Since April 12, 2022.

12) Until April 12, 2022.

13) Until April 12, 2022.

14) Since April 12, 2022.

15) Since April 12, 2022.

16) Since April 12, 2022.

17) Since April 12, 2022.

18) Since April 12, 2022.

19) As amended on April 13, 2023.

Additional mandates of members of the Board of Directors outside the medmix group

According to Art. 33 of medmix’ Articles of Association (on medmix.swiss/en/Investors/Governance; under Downloads), the maximum number of additional mandates held by members of the Board of Directors outside the medmix group is ten (of which a maximum of four mandates may be with listed companies). Exceptions (e.g., for mandates held at the request of medmix or mandates in charity organizations) are also defined in Art. 33 of the Articles of Association. All board members comply with these requirements and no exceptions were granted in the reporting period.

Audit Committee

The Audit Committee (members listed above) assesses the midyear and annual consolidated financial statements and, in particular, the activities – including effectiveness and independence – of the internal and statutory auditor and the cooperation between the two bodies. It also assesses the internal control system as well as risk management and compliance, with at least one meeting per year dedicated to risk management and compliance. The Regulations of the Audit Committee can be viewed on medmix.swiss/en/Investors/Governance (under Downloads). The CFO, the Secretary of the Board, the Deputy CFO (who is also the secretary of this Committee) and the external auditor-in-charge attend the meetings of the Audit Committee. In 2022, the Audit Committee held four meetings. The statutory auditor attended the meetings, and internal subject matter experts gave presentations to the Audit Committee during the meetings.

Nomination and Remuneration Committee

The Remuneration Committee (members listed above) was renamed the Nomination and Remuneration Committee in 2022. It assesses the compensation systems and recommends compensation for the members of the Board of Directors and the Executive Committee (including short-term and long-term incentive components) on behalf of the Board of Directors and in accordance with its specifications. It carries out broad compensation benchmarking with an international comparison group, supported by studies of consulting firms, if necessary, and it scrutinizes the work of internal and external consultants. The Nomination and Remuneration Committee also deals with nomination matters and assesses the criteria for the election and re-election of board members and the nomination of candidates for the Executive Committee. It is furthermore responsible for the succession planning for the CEO and the Executive Committee. The members of the Nomination and Remuneration Committee are elected by the shareholders’ meeting. The Nomination and Remuneration Committee Regulations are available on medmix.swiss/en/Investors/Governance (Under Downloads). The CEO and the Chief Human Resources Officer attend the meetings of the Nomination and Remuneration Committee. In 2022 the Nomination and Remuneration Committee held five meetings.

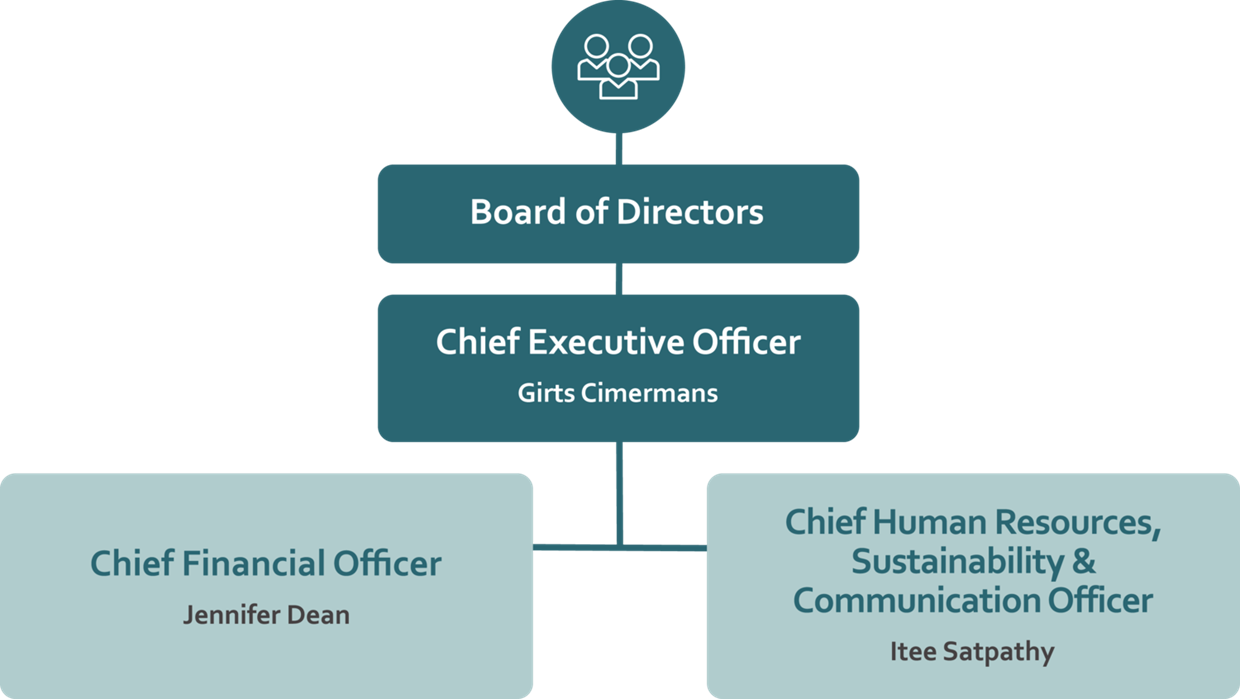

Division of powers between the Board of Directors and the CEO

The Board of Directors has largely delegated executive management powers to the CEO. However, it is still responsible for matters that cannot be delegated in accordance with Art. 716a of the Swiss Code of Obligations. These matters include corporate strategy, the approval of mid-term planning and the annual budget, key personnel decisions, and the preparation of the compensation report. The same applies to acquisition and divestiture decisions exceeding CHF 20 million, investments in fixed assets exceeding CHF 10 million, major corporate restructurings, approval of dispute settlements with an impact on operating income of more than CHF 5 million, approval of research and development projects exceeding CHF 5 million, other matters relevant to the company, and decisions that must be made by law by the Board of Directors. The competency regulations and the nature of the collaboration between the Board of Directors and the Executive Committee can be viewed in the Organizational Regulations of the Board of Directors on medmix.swiss/en/Investors/Governance (Under Downloads).

Information and control instruments

Each member of the Board of Directors receives a copy of the monthly financial information (January to May and July to November), plus the midyear and annual financial statements. These include information about the balance sheet, the income and cash flow statements, as well as key figures for the company and its market segments. They incorporate comments on the respective business results and a rolling forecast for the current business year. The CEO and CFO report at every Board meeting on business developments and all matters relevant to the company. Once per year, the Board receives the forecasted annual results. During these Board meetings, the Chairs of the Committees also report on all matters discussed by their committees and on the key findings and assessments, and they submit proposals as required. Each year, the Board of Directors discusses and approves the budget for the following year and the midterm plan, the latter being subject to periodic review. The Chairman of the Board of Directors regularly consults with the CEO and other representatives of the Executive Committee with respect to strategic matters and focus areas. In addition, the Board of Directors receives a status update on investor relations on a regular basis and each member of the Board may request information regarding all matters relating to the group’s business.

Group Internal Audit

In 2022, the group hired its own Head of Internal Audit. On individual assignments, the group’s Internal Audit received support from Sulzer group under the Transitional Services Agreement.

The objective of Group Internal Audit is to provide independent objective assurance and other services to help ensure that medmix group operates in accordance with the management, internal controls and governance processes, which are adequate for the achievement of business objectives. Group Internal Audit is approved to provide assurance services to both medmix and external stakeholders such as external auditors. Meetings between internal audit and the statutory auditor take place on an annual basis to discuss the internal audit organization and approach.

Group companies are audited by Group Internal Audit based on an audit plan that is approved by the Audit Committee. Special audit assignments may be performed upon request of a member of the Board of Directors, the Executive Committee or company management, with prior approval from the Chair of the Audit Committee.

In 2022, Group Internal Audit carried out four new audits and one follow-up assignment to verify the implementation of recommendations from previous audits. Additionally, Group Internal Audit delivered two consulting assignments to assist the company’s management in meeting its objectives. One of the focal points was the internal control system as well as compliance with the company’s governance structure.

The results of each audit and key remediation measures are discussed in detail and agreed upon with the companies and also shared with members of the medmix executive team. The Chairman of the Board of Directors, the members of the Audit Committee, the CEO, the CFO, the Deputy CFO, the COO and other line managers of the audited entity receive a copy of the audit report. Significant findings and recommendations are also presented to and discussed with the Executive Committee. A follow-up process is in place for all group internal audits, which allows efficient and effective monitoring of how the improvement measures are being implemented.

Group Internal Audit prepares a summary of audit activities and results, along with the status of implementation of improvement measures. On a quarterly basis, the Head of Internal Audit presents the summary to the Audit Committee and, thereafter, it is reported to the Board of Directors.

Risk management and compliance

During the reporting period, medmix Ltd benefitted from the Sulzer group compliance and risk management set up and support in accordance with the Transitional Service Agreement. Hence, medmix Ltd leveraged Sulzer group’s comprehensive compliance program. During this time, 1'058 employees in defined targeted groups participated in compliance e-learning modules with a focus on anti-corruption, anti-bribery, diversity and respect. Five internal compliance investigations were carried out, mainly related to employment issues. Each had a low financial impact and carried no reputational risk. Adequate disciplinary measures were taken.

In order to maintain a comprehensive and robust compliance management system across medmix group and to support a seamless transition, the compliance management processes of Sulzer were assessed and used to start adapting medmix’ compliance processes to the group’s specific compliance risks. In 2022, medmix launched its own compliance hotline and incident reporting system based on a specialized vendor-based compliance tool and systems. Such reports can be made anonymously or openly via a free hotline or a dedicated website. Furthermore, a directive sets clear rules for internal investigations.

medmix places high priority on conducting its business with integrity, in compliance with all applicable laws and internal rules, and on accepting only reasonable risks. In the course of the spin-off, medmix , under the supervision of its Chief Compliance Officer, implemented an internal control system as well as several policies and directives addressing different compliance topics, such as a Code of Business Conduct published on medmix.swiss/en/Investors/Governance (under Downloads) and rules regarding antitrust risks, bribery and corruption, export control and other risks (e.g., non-compliance with stock exchange laws and regulations, insufficient protection of intellectual property and know-how, violations of privacy and data protection or with regard to environment, quality, safety and health). The Chief Compliance Officer is responsible for the further development of medmix group’s compliance management system

With the hiring of the medmix Chief Compliance Officer, a compliance risk analysis took place that formed the basis of the medmix integrated Compliance Management System (CMS), covering organizational and procedural principles and measures to ensure compliance with legal requirements and internal company guidelines. The medmix CMS targets the principles of good corporate governance, proportionality, integrity, transparency, accountability, and sustainability.

The medmix integrated CMS is structured in three main pillars: Prevention, Detect and React.

Prevention measures to avoid misconduct and compliance risks were implemented through the medmix Compliance Hotline, worldwide centralized Compliance Training and Campaign Platform, the corporate Due Diligence process performing integrity checks and the Policy Manager accessible to all employees. The Code of Business Conduct carries the measures at its core.

Detect: instruments for detecting misconduct were established through the whistle-blower system, internal audit, and compliance controls.

React: continuous improvement through monitoring, audits, and investigations to correct or eliminate weaknesses in processes and controls, as well as defining disciplinary measures.

The CMS is regularly reviewed, evaluated and, if necessary, adapted. This enables a continuous risk assessment and adaptation to the actual risk situation of the company with a formal yearly Enterprise Risk Management review as described thereafter.