— Compensation report — Compensation architecture for the Executive Committee

Compensation architecture for the Executive Committee

Compensation principles

The compensation of the Executive Committee is driven by the main principle of pay for performance. The compensation policy and programs are designed to reward performance, sustainable growth and long-term shareholder value creation, while offering competitive remuneration to be able to attract and retain highly qualified employees. The compensation system is based on the following guiding principles:

|

Guiding principles |

|

|

|

Pay for performance |

|

The variable compensation is linked to the individual as well as the company performance and represents a substantial part of the overall compensation package. |

|

Link to strategy |

|

The performance indicators of the variable compensation are selected to create incentives to implement the defined strategic and operational goals of medmix. |

|

Shareholder alignment |

|

Part of the variable compensation is directly dependent on the capital market performance of the medmix share, to align the compensation of the Executive Committee with shareholder interests. |

|

Market practice |

|

The compensation for the Executive Committee is designed to offer a fair and competitive compensation package that is in line with market practice. |

|

Good corporate governance |

|

medmix is committed to the principles of good corporate governance. The compensation system is designed to comply with the Swiss Code of Best Practice for Corporate Governance. |

|

Clear structure |

|

The compensation system is structured in a clear and comprehensible manner and is transparently disclosed in the compensation report. |

Assessment of level of compensation

To ensure compensation levels that are competitive and in line with market practice, the compensation of the Board of Directors and of the Executive Committee is regularly benchmarked against that of similar roles in comparable companies every one to two years. For this purpose, the Nomination and Remuneration Committee selected a peer group of international industrial and medical technology companies headquartered in Switzerland, based on their revenue and number of employees. medmix is positioned between the first quartile and median of the peer group. The comparison group reflects medmix’ ambitious business strategy:

- Aevis Victoria

- Bachem

- Comet

- Galenica

- INFICON

- Landis+Gyr

- Medacta

- Medartis

- Siegfried

- Tecan

- Vifor

- Ypsomed

The intention is to pay target compensation around the median of the relevant market. Nevertheless, potential compensation increases are not granted based on benchmark results alone. The role and responsibility as well as current performance of the individual Executive Committee member is assessed at the same time. A globally consistent job-grading structure fosters internal equity.

Compensation elements and their application for financial year 2022

The compensation of the Executive Committee comprises fixed and variable components. The fixed compensation of the members of the Executive Committee consists of a base salary, allowances payable in cash and contributions to pension schemes or similar benefits. In addition, the members of the Executive Committee are eligible for performance-based short-term variable compensation (performance bonus plan) paid in cash and long-term variable compensation (performance share plan (PSP)) paid in performance share units (PSUs). The members of the Executive Committee participate in the medmix PSP from 2022 onwards. These variable compensation components foster a successful development of medmix in the short term as well as in the long term.

The following table shows the compensation components and provides a brief description of how these components are linked to the guiding principles:

Compensation elements for the members of the Executive Committee

|

|

|

Base Salary |

|

Fringe benefits and pension contributions |

|

Short-term variable compensation (STI) |

|

Long-term variable compensation (PSP 2022) |

|

Share ownership guidelines (SOG) |

|

Main parameters |

|

Function, level of role, profile of incumbent (skill set, experience) |

|

Pension and social security contributions, fringe benefits |

|

Achievement of annual financial and individual objectives |

|

Achievement of long-term, company-wide objectives, share price development |

|

Level of role |

|

Key drivers |

|

Labor market, internal job-grading |

|

Protection against risks, labor market, internal job-grading |

|

Revenue, operational profitability %, adjusted operating net cash flow (adjusted ONCF)% |

|

Growth, profitability and share development |

|

Share price development |

|

Link to compensation principles |

|

Competitive compensation |

|

Competitive compensation |

|

Pay for performance, strategy alignment |

|

Pay for performance, strategy alignment, ownership |

|

Ownership |

|

Vehicle |

|

Cash |

|

Pension and insurance plans, perquisites |

|

Cash |

|

Performance share units (PSU) settled in shares |

|

Obligation to hold required threshold of shares until the end of the service period |

|

Amount |

|

Fixed |

|

Fixed |

|

Variable, capped at 200% of target bonus. Target bonus amounts to 80% of annual base salary for the CEO and 50% of annual base salary for the other members of the Executive Committee. Clawback provisions implemented. |

|

Variable. Grant value is defined based on the Global Grade and corresponds to CHF 550’000 for the CEO and between CHF 130’000 and CHF 160’000 for the other members of the Executive Committee (EC). Vesting payout percentage is capped at 250% and vesting value is capped at CHF 1’375’000 for the CEO and at CHF 325’000 to CHF 400’000 for the other members of the EC. Malus and clawback provisions implemented. |

|

CEO: 200% of base salary. Other members of the Executive Committee: 100% of base salary. |

|

Grant/vesting/payment date |

|

Monthly |

|

Monthly and/or annually |

|

March of the following year |

|

Grant: April 1, 2022 Vesting: January 1, 2025 Share delivery: not later than March 31, 2025 |

|

– |

|

Performance period |

|

– |

|

– |

|

1 year (January 1, 2022–December 31, 2022) |

|

3 years (January 1, 2022–December 31, 2024) |

|

– |

The variable compensation of medmix is designed to create reasonable incentives for the Executive Committee, to align the interests of the Executive Committee and shareholders, to ensure pay for performance and to implement the company’s strategy in the compensation of the Executive Committee.

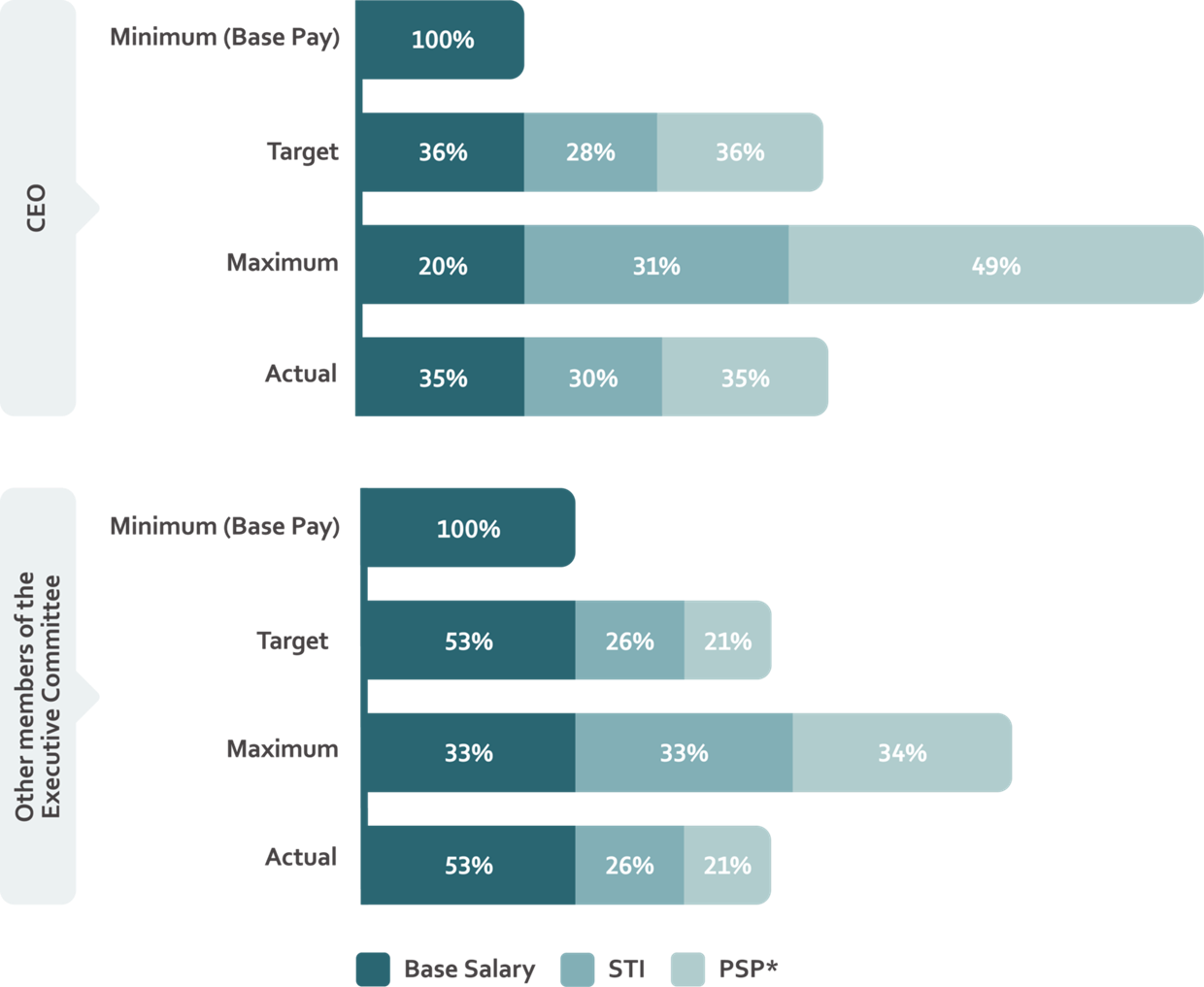

The Executive Committee’s compensation puts a clear focus on the fulfillment of the performance targets defined within the variable compensation. The following illustration highlights the strong link between performance and compensation based on selected performance scenarios. It represents the compensation structure, i.e., the ratio between base salary, short-term variable compensation and long-term variable compensation, for three different hypothetical scenarios (minimum target achievement, 100% target achievement and maximum target achievement (not considering any share price increase) for the fiscal year of 2022:

* Excludes the additional grant reflecting the PSP forfeited at the spin-off of medmix from Sulzer in 2021 (described in the “Spin-off and corresponding Sulzer PSUs” section of this report).

In line with the pay for performance principle, a significant portion (~55%) of the target compensation of the CEO and of the other members of the Executive Committee consists of variable incentives based on performance. Furthermore, the compensation structure ensures sustainable long-term growth as the long-term variable compensation makes up the largest portion of the target total compensation.

Fixed compensation

Base salary

The base salary is determined at the discretion of the Board of Directors based on the market value of the respective position and the incumbent’s qualifications, skill set and experience and is paid out in cash. A global job-grading structure provides orientation and fosters internal equity.

Fringe benefits

As additional fixed compensation elements, the members of the Executive Committee receive allowances such as relocation allowances, tax services or child allowances. All such allowances are paid in cash. Furthermore, they receive contributions to social security.

Pension

Members of the Executive Committee participate in the regular employee pension funds applicable to all employees in Switzerland. The retirement plan consists of a basic plan that covers annual earnings up to CHF 149’125 per year and a supplementary plan in which income over this limit, up to the ceiling set by law, is insured (including variable cash remuneration). The contributions are age-related and are shared between the employer and the employee.

Variable compensation

Short-term variable compensation

General functionality

As short-term variable compensation, Executive Committee members are granted the performance bonus plan under which they receive annual, variable, and performance-related compensation.

Under the performance bonus plan, the members of the Executive Committee receive an annual target bonus amount that is expressed as a percentage of the annual base salary (CEO: 80% of base salary; other members of the Executive Committee: 50% of base salary).

The determination period of the performance bonus plan is one financial year. The final payout amount depends on the performance assessed against the predefined performance objectives during the respective performance period. The performance bonus plan comprises financial objectives with a weighting of 70% as well as individual objectives with a weighting of 30%. The relevant performance objectives and their respective weighting are defined at the beginning of the year during the annual target setting. The selected performance objectives are thereby clearly aligned with the corporate strategy of medmix and support the short-term success of the company. They reflect the areas of focus for medmix and relate to key value drivers by underpinning the financial performance of the medmix group. The target achievement of the financial and individual objectives depends on the performance during the financial year and can range between 0% and 200% for each objective. The achievement is assessed against each of the predefined objectives after year-end and directly impacts the payout.

The final payout amount is determined by multiplying bonus relevant annual salary and target bonus amount with the overall target achievement, which is calculated based on the target achievement in the performance objectives taking into account their respective weighting.

The financial and individual achievements of the members of the Executive Committee are subject to review and approval by the Nomination and Remuneration Committee and the Board of Directors, respectively.

Relevant objectives

For the CEO and the other members of the Executive Committee, the payout amount of the Performance Bonus Plan depends on the appraisal of performance against a maximum of six financial objectives and six individual objectives. The objectives for the financial year 2022, as well as their respective weighting, are described in the table below:

Performance bonus plan objectives

|

Category |

|

Category weighting |

|

Objective |

|

Rationale |

|

Objective weighting |

|

|

Financial objectives |

|

70% |

|

Revenue |

|

Measure of growth (top line) |

|

30% |

|

|

|

|||||||||

|

Adjusted EBITDA margin |

|

Measure of profitability (bottom line) |

|

25% |

|

||||

|

|

|||||||||

|

Adjusted operating net cash flow (adjusted ONCF) |

|

Measure of cash generated by the revenues |

|

15% |

|

||||

|

|

|||||||||

|

Individual objectives |

|

30% |

|

Cost-efficiency |

|

Achieving growth targets while aiming for increased profitability |

|

8.33% |

|

|

Growth initiatives |

|

Include initiatives that support the growth of medmix, such as M&A projects, breaking into new markets or new accounts |

|

8.33% |

|

||||

|

Operational excellence |

|

Initiatives focused on the product launches, manufacturing capacities and improving speed and efficiency of processes |

|

8.33% |

|

||||

|

Sustainability |

|

Objectives linked to improvements in the areas of environment, employee engagement and local communities, corporate governance |

|

5% |

|

||||

|

Total target achievement |

|

100% |

|

||||||

The objectives are set within the annual target-setting process. For each financial objective, the following parameters are set up front:

- An expected level of performance (“target”), the achievement of which leads to a target achievement (on the respective performance metric) of 100%.

- A minimum level of performance (“threshold”) below which the respective target achievement is zero.

- A maximum level of performance (“cap”) above which the respective target achievement is capped at 200%. With respect to the financial objectives, a performance of 200% of the target figure is required to achieve a target achievement of 200%.

Between threshold and target, as well as between target and cap, the target achievement is interpolated linearly.

As part of the assessment of their individual performance, each Executive Committee member is given objectives for their respective area of responsibility and an additional objective related to supporting sustainability through environment, social, governance (ESG) efforts.

The Sustainability objective includes improvements in health and safety, emissions, water and energy efficiency or initiatives and actions taken to increase employee and community engagement or efforts in R&D for more efficient or sustainable products. The CEO reviews the individual performance based on the personal objectives of each Executive Committee member, which in turn is reviewed by the Nomination and Remuneration Committee. The CEO’s individual performance is assessed by the Nomination and Remuneration Committee.

medmix strives for transparency in relation to pay for performance. However, further disclosure of financial and individual objectives may create a competitive disadvantage to the company because it renders sensitive insights into medmix’ strategy. To ensure transparency while avoiding competitive risk, medmix provides a general performance assessment for each financial objective as well as the aggregated individual performance at the end of the performance cycle.

Payout from the performance bonus plan 2022

medmix has deconsolidated and intends to sell its manufacturing operations in Wroclaw, Poland. As a result of direct sanctions levied by the Polish government on its minority shareholder, medmix had to suspend operations at this site.

These negative developments in Poland were neither foreseeable at the time of target setting, nor were they caused by the current management or the company. Having taken all available measures, the company has not received a positive response from the Polish government to be removed from sanctions and to allow the reopening of its Wroclaw facilities.

Taking all relevant factors into account, the Board of Directors decided not to revise the initial financial targets during the year and to keep the possibility to assess the impact of the Poland closure. The assessment was carried out in December and the effect of the deconsolidated Polish business is neutralized for the 2022 financial year which corresponds to CHF 35m in adjusted revenue, CHF 40m in adjusted ONCF, and a variation of EBITDA margin from 22% to 24%, resulting in a financial achievement of 93%.

The final payout amount of the performance bonus 2022 is based on the total target achievement and the target bonus amount. The total target achievement is calculated by taking the sum of the target achievement of the financial objectives and the individual objectives multiplied with their respective weighting. The payout from the performance bonus plan 2022 can be summarized as follows:

Performance bonus plan 2022: Summary

|

|

|

Target bonus amount |

|

Target achievement |

|

Payout amount |

||||

|

thousands of CHF |

|

|

|

Financial objectives (weighting 70%) |

|

Individual objectives (weighting 30%) |

|

Total |

|

|

|

Girts Cimermans, CEO |

|

440 |

|

93.0% |

|

130% |

|

104% |

|

458 |

|

Other members of the Executive Committee |

|

360 |

|

93.0% |

|

115% |

|

100% |

|

360 |

Long-term variable compensation

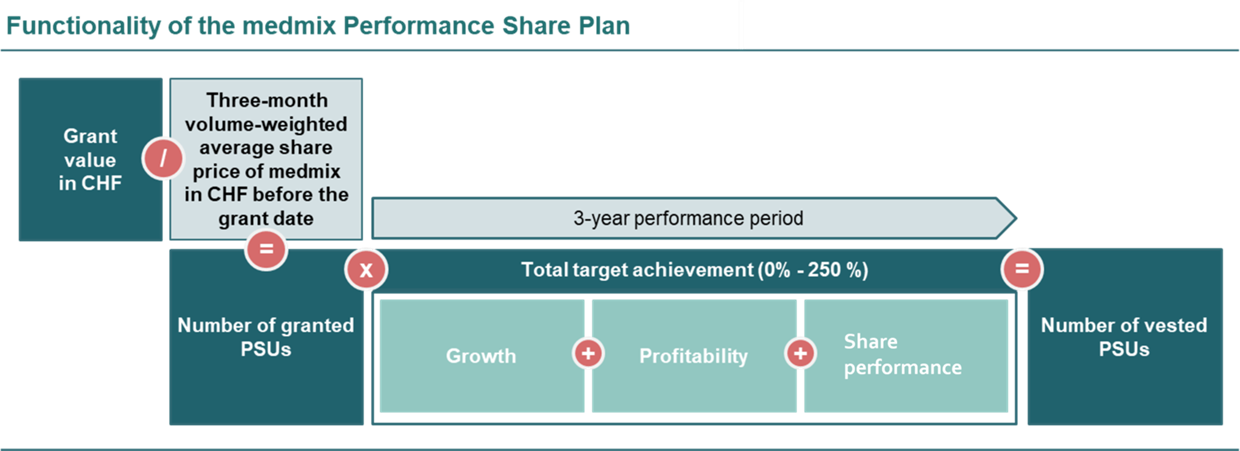

General functionality of the medmix performance share plan

Members of the Executive Committee and other selected individuals employed in defined roles belonging to medmix are eligible to participate in a long-term variable compensation component, called a performance share plan (PSP). Given the spin-off of medmix from Sulzer in financial year 2021, the first regular grant of the medmix PSP occurred in financial year 2022. The PSP consists of rolling annual plans, which allows the Board of Directors to review and adjust the terms and targets on an annual basis.

The PSP incentivizes long-term shareholder orientation and value creation and aligns the interests of the participants with those of the shareholders by delivering a substantial portion of the compensation as company equity. This underlines the focus of medmix on pay for performance and sustainable growth, with a long-term perspective and additional retention effect on employees.

The grant value is determined based on the level of the executive’s role and amounts to CHF 550’000 for the CEO and to between CHF 130’000 and CHF 160’000 (determined by the Board of Directors) for the other members of the Executive Committee. The number of PSUs granted is calculated by dividing the individual grant value by the three-month volume-weighted average share price of medmix before the grant date, rounded up to the next full number of PSUs.

PSUs are conditional awards to receive a certain number of shares after the performance period. Until the actual transfer of shares, PSUs do not constitute any shareholder rights (voting, dividend, etc.).

Relevant objectives

The vesting of PSUs is subject to the achievement of pre-determined performance conditions. The objectives are linked to medmix’ strategy. To support this, they are chosen to provide different incentives for profitable growth and shareholder value creation. The key performance criteria are measured over a 3-year performance period and consist of:

- Growth: Measured by the revenue of medmix based on the consolidated financial statements, weighted with 30%.

- Profitability: Measured by the adjusted EBITDA margin, weighted with 30%.

- Share performance: Measured by the relative share price development in comparison to the Swiss Performance Index excluding dividends, weighted with 40%.

For each performance condition of the PSP, a threshold, target and cap performance level is determined, which in turn determines the achievement factor.

For growth and profitability, the thresholds, targets and cap performance levels are determined as follows:

|

Level of performance |

|

Achievement factor |

|

Below threshold |

|

0% |

|

Threshold |

|

50% |

|

Target |

|

100% |

|

Cap |

|

250% |

|

Points in between |

|

Linear interpolation |

For share performance in comparison to the Swiss Performance Index of the PSP, the threshold, target and cap performance level is determined as the following:

|

Level of performance |

|

Achievement factor |

|

≤ Threshold |

|

0% |

|

Target |

|

100% |

|

Cap |

|

250% |

The number of vested PSUs will be determined by multiplying the number of originally granted PSUs by the total achievement factor, rounded up to the next full number of vested PSUs. For each vested PSU, one share will be transferred to the individual securities account on the share delivery date. The number of vested PSU is subject to an absolute value cap of 2.5 times the original grant value, represented by the cap of each KPI.

In case of termination of employment, the following provisions apply:

|

Type of termination |

|

Provision |

|

By the employer for cause |

|

All relevant outstanding PSUs, whether vested or not, shall lapse immediately on the Notice Date without any compensation. |

|

As a result of retirement |

|

Outstanding PSUs shall continue unchanged. |

|

Any other reason |

|

The number of outstanding PSUs shall remain unchanged, where the number of outstanding PSUs that continue to be eligible for vesting shall be prorated and the effective total achievement factor shall be applied after expiry of the full performance period. |

Upon the occurrence of a change of control, the number of outstanding PSUs shall be prorated and vest immediately.

Spin-off and corresponding Sulzer PSUs

At the time of the spin-off of medmix from Sulzer in autumn 2021, the members of the Executive Committee were participants in the Sulzer PSP tranche 2019 to 2021. As part of this, they had previously been granted a number of Sulzer PSUs. Because of the spin-off, the number of granted, unvested PSUs were pro-rated on the basis of the portion of the total performance period during which the company was a part of the Sulzer group. This prorated number of PSUs will continue to vest on the normal vesting dates (i.e., no acceleration), thus also be subject to ongoing performance measurement throughout the entire original performance period. Further, the portion of PSUs forfeit as a result of the prorating have been taken into consideration for the determination of the grant amounts for the affected members of the Executive Committee under the new PSP of medmix starting 2022. This one-off, spin-off correction-related grant was made together with the regular grant cycle in April 2022.

|

|

|

Grant value |

|

Spinoff related adjustment grant value * |

|

Three-month volume-weighted average share price of medmix before the grant date |

|

Number of PSUs granted |

|

Number of PSUs granted due to forfeiture of Sulzer PSUs |

|

Girts Cimermans |

|

550’000 |

|

636’100 |

|

33.8798 |

|

16’234 |

|

18’776 |

|

Jennifer Dean |

|

160’000 |

|

178’811 |

|

33.8798 |

|

4’723 |

|

5’278 |

|

Itee Sapathy |

|

130’000 |

|

- |

|

33.8798 |

|

3’838 |

|

- |

* Additional grant value, compensated for the portion of PSUs forfeited during the spinoff of medmix from Sulzer in the financial year 2021.

Contractual arrangements

Service contracts

The employment contracts of the Executive Committee are of undetermined duration and have a maximum notice period of 12 months. Members of the Executive Committee are not entitled to any impermissible severance or change of control payments. The employment contracts of the Executive Committee may include non-compete agreements with a time limit of one year and with a maximum total compensation of one annual target compensation.

Shareholding requirements

In 2022, shareholding requirements for members of the Executive Committee were introduced. According to these share ownership guidelines (SOG), the members of the Executive Committee are obliged to hold part of their shares until the end of their service period. The value of the shares to be held is set at 200% of the annual gross base salary for the CEO and 100% of the annual gross base salary for the other members of the Executive Committee.

|

Function |

|

Shareholding requirement in % of base salary |

|

CEO |

|

200% |

|

Other Executive Committee members |

|

100% |

Malus and clawback

The Board of Directors may determine that long-term variable compensation is forfeited in full or in part (malus) or that a vested award will be recovered in full or in part (clawback) in situations of material misstatement of the financial results, an error in assessing a performance condition or in the information or assumptions on which the award was granted or vested, serious reputational damage to the company, gross negligence, or willful misconduct on the part of the participant. In 2022, the clawback clause was extended to cover performance bonus payments, whereby medmix may recover in full or in part any relevant bonus compensation from Executive Committee members in situations of material misstatement of the financial results, an error in assessing a performance condition or gross misconduct of the participant.